Diving into the economics that govern the crypto space; tokenomics. This article will address supply, distribution, issuance and a new tokenomic model, veTokenomics. The target audience for this article ranges from crypto beginners to experienced DeFi users.

We’ve now discussed DAOs to great lengths, and it’s time to dive into the underlying asset behind all DAOs - the token. Along with the release of a token comes the tokenomics that govern the asset. We’ll be diving into what a token is, the main pillars of tokenomics, the veTokenomics model and finally, the DexGuru token model recently proposed on Snapshot.

What is a token?

“Token” is a term commonly used in the crypto space. Although there can be many definitions of a token, we will stick to a single concise definition for the sake of this article.

A token is a term used to describe crypto assets that run on top of a blockchain that is not its own. For example, Ether (ETH) is used when transacting on the Ethereum blockchain, and this is not a token as ETH is the underlying asset of the blockchain. Whereas GURU would also be tradeable on Ethereum but is built on top of the blockchain, making it a token. Using this definition, Ether and bitcoin are coins as they are foundational to their blockchains.

There are many unique token types, such as ERC721 tokens and ERC1155 tokens, more commonly known as NFTs, and ERC20 tokens, which are the fungible assets widely used in DeFi (Aave, Maker, Uniswap).

These tokens have more than one use case in the DeFi space, with new uses being developed frequently. A few of the more common cases are:

Ownership – A token can represent ownership or be used to grant access. This can be applied to DAO voting, where the more tokens an individual holds, the more voting power they have.

Value Exchange or DeFi tokens – Tokens are used internally and externally to exchange the value created by a DeFi project. These protocols issue tokens that perform various functions but can also be traded or held like any other cryptocurrency.

Utility – DeFi projects have specific use cases for their tokens. An example of this would be if only GAME token holders could play the game that the founding team produced.

Benefits Distribution – Tokens are critical to the equitable distribution of increased value. They are the key mechanism for allowing owners of a token to share in the upside of a protocol.

Tokenomics

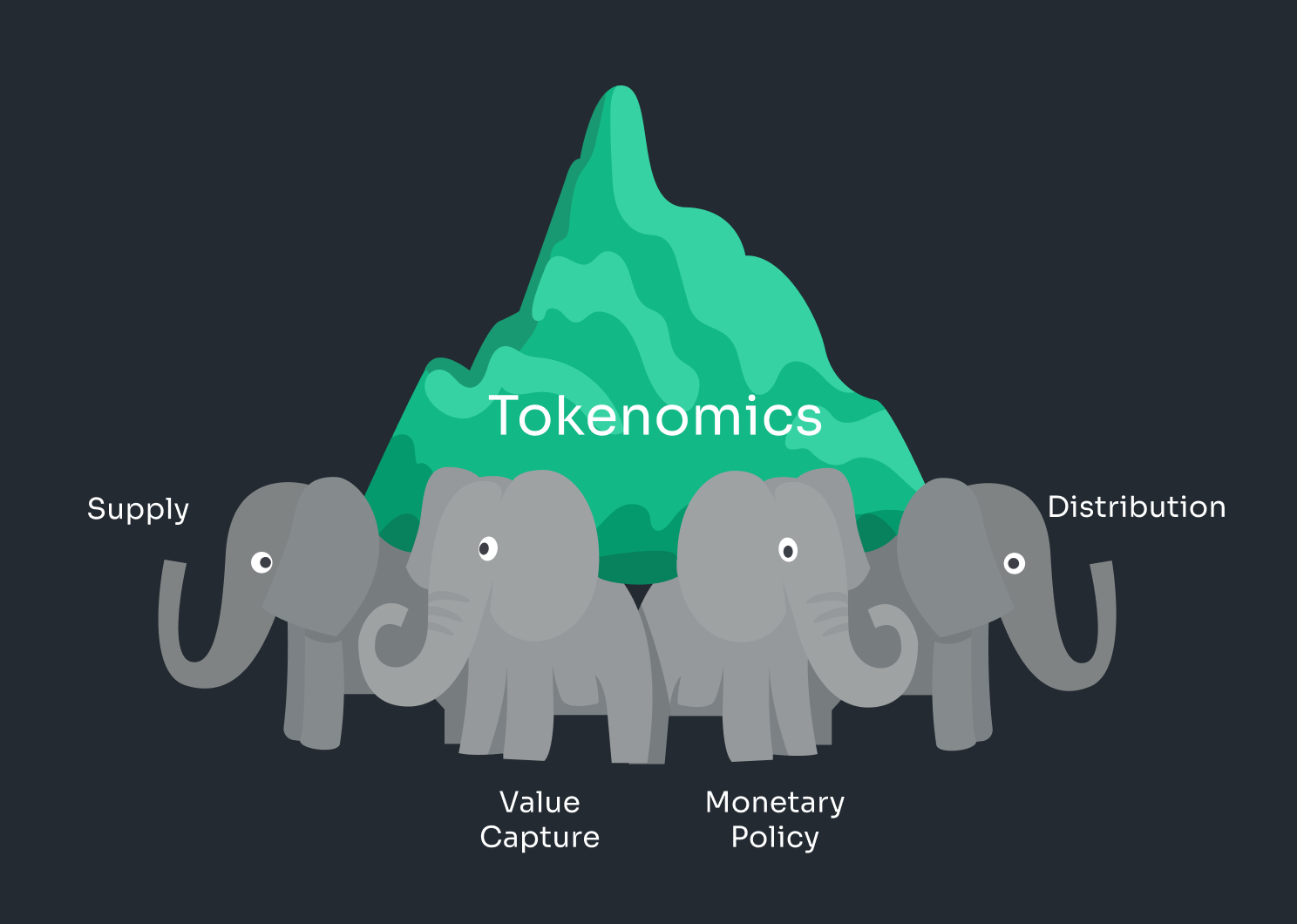

Now that we’ve established a base for token understanding, we’ll dive into tokenomics, the DeFi-specific study of choice under scarcity. The goal of tokenomic analysis is to understand the potential value of a DeFi project by considering all aspects of a token’s creation and management, including its supply, allocation, and distribution. The law of supply and demand is immutable, meaning tokenomics significantly impact the value of every cryptocurrency, NFT, and DAO.

Four fundamental tokenomic pillars make up every token, and it’s the first thing an investor should analyze before diving deeper into the economics. Any design flaws in these pillars are a clue that the foundation isn’t solid and may cause significant issues later on.

Supply

We can split the supply up into:

- Circulating Supply: The number of tokens that are in the market.

- Max Supply: Maximum number of tokens that can exist for the protocol.

- Total Supply: The number of tokens that have been issued, including burned & locked up tokens.

A higher supply of token A can mean its price is much lower than token B while holding the same market cap. Unit bias is a significant factor in the crypto space, with users making remarks like, “Cardano is only $1; imagine how much money I will make if it reaches 50% of Bitcoin’s price!” They are missing that Cardano has a 45B supply compared to Bitcoin’s 21M. Using market cap as a tool for comparison provides more helpful information.

Another helpful strategy before investing is to compare the circulating supply to the total and max supply. If the circulating supply is low while the total and max are high, it is likely that as new tokens enter into circulation, the value of each one is diluted. Think of this like token inflation, with each token becoming less scarce as new ones enter the market. If the circulating supply and max supply are close in magnitude, this is just the first check of many, but an investor has one less foundational risk factor.

Distribution

The distribution of a coin is the next tokenomic pillar that investors should consider. The distribution is the percentage of the total supply that each wallet holds. Investors should most likely shy away from a token where 70% of the supply is held by one individual, given that the project is now somewhat centralized. This user could theoretically sell the token - using the other 30% of holders as exit liquidity and destroy the project’s reputation.

An excellent distribution design is when no single person or group holds a large amount of the token, ensuring it’s distributed among many individuals. This way, if any single user wants to liquidate their holdings, selling won’t have too much of an impact on the token price. The best way to determine the distribution of a token is by checking their whitepaper for the token allocation chart and by reading the distribution among wallets on a blockchain explorer.

Monetary Policy

The monetary policy in crypto dictates whether a token is inflationary or deflationary and by how much. High inflation can cause the asset price to go down over time, and a low inflation rate can lead to a healthy and productive ecosystem. Tokens can inflate by offering rewards in yield farming or by selling off the DAOs treasury assets. These actions aren’t harmful but should be monitored for overuse.

Value Capture

The final pillar to monitor is how much value the protocol is capturing and how that value is distributed. In Web2, all of the value captured went back to the company and was distributed within. This way, companies such as Facebook, Google, and Twitter make billions of dollars off of their users’ data and social media interactions while the users earn nothing in return. Web3 flips this on its head as the protocol captures the value and distributes it to token holders. This way, early adopters and users can profit from the platforms they love.

Unfortunately, not all protocols capture value efficiently. There is still research and experimentation needed until we have a tokenomic architecture that can capture 100% of a protocol’s value.

The Uniswap vs Sushiswap battle in 2020 highlights the differences in DeFi value capture. Uniswap released their AMM (automated market maker) early on but did not release a token. They provided an innovative product with tons of value, but they captured 0% of the value for network participants. Sushiswap then forked Uniswap and created the SUSHI token along with it. SUSHI holders from the beginning were able to vote on governance issues as well as stake their SUSHI for xSUSHI and receive the transaction fees that the protocol generated. While this model is far from perfect, having token holders share in the revenue captures more value than Uniswap’s model. If Uniswap had come out with a token that captured value when the AMM was released, it would have been much more difficult for Sushiswap to gain traction.

Looking for synergy/chaos between the interactions of the various fundamental pillars lets us figure out how well designed the tokenomics are. It is important to remember that taking one pillar and forming an opinion will give an incomplete picture.

veTokenomics (Curve)

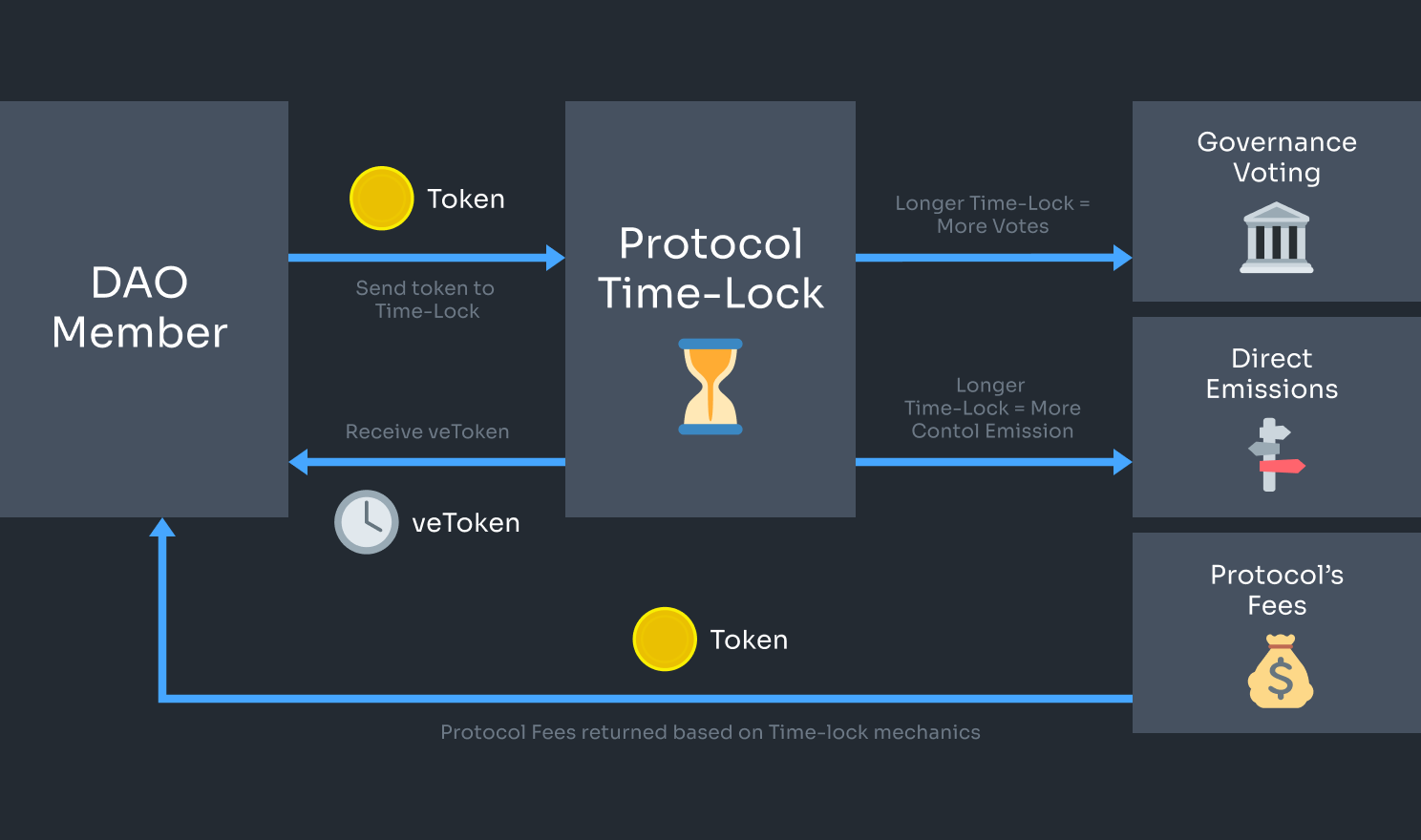

The “ve” model created by Curve Finance is quickly becoming a popular tokenomics model with newer DeFi protocols.

It works by having users lock up their tokens and having them converted into veToken, which holds the governance power of the protocol. The lock period isn’t fixed, meaning the token holder can decide how long they want to lock their token, up to 4 years. As time goes on, the amount of veToken that a holder has decays linearly throughout their lockup period, incentivizing the holder to relock their tokens for veTokens periodically to maximize governance and rewards. The main innovation is how this creates weighted votes and weighted rewards. In addition, once a token is converted into veToken, it is locked in for that specified period. There is no unstaking the asset early, as seen in other protocols.

Let’s say Bill and Alice each have 100 tokens. Bill decides to lock his token for two years, while Alice locks her for four years. Although they started with the same amount of tokens, Alice will receive double the amount of veTokens as Bill, which means she will have double the governance votes and rewards.

One of the main problems that veTokenomics solves is the one token = one vote problem. Under a non-ve model, whales can buy many tokens for short-term governance and yield rewards without having any skin in the game other than short-term price. A protocol can buy up millions of dollars of a competing protocol and vote in favour of harmful proposals before dumping the token. Under the “ve” model, whale manipulation is much less effective as their votes won’t be as valuable compared to a long-term holder.

The veTokenomic model helps align the values of token holders and DAO voters in ensuring that the long-term thinkers and actors push the protocol forward with proper intentions.

With all this tokenomic understanding, we’re looking forward to diving into the GURU tokenomics once the DAO sets them in a later article.