This article takes a look into metagovernance, how it’s used, and some high profile examples of metagovernance in action within the world of DeFi.

As DexGuru continues its mission towards decentralized governance, we aim to educate the readers on decentralization in today’s world. With this article focusing on metagovernance, we hope to shed a light on its purpose, use cases, and exciting examples of DeFi implementation. As always, a full webinar of the discussed topics is available.

What is Metagovernance?

Metagovernance is the act of one DAO participating in the governance process of another DAO through the use of a token. This is often done to leverage voting power in one DAO for the benefit of another DAO.

An Example of Metagovernance

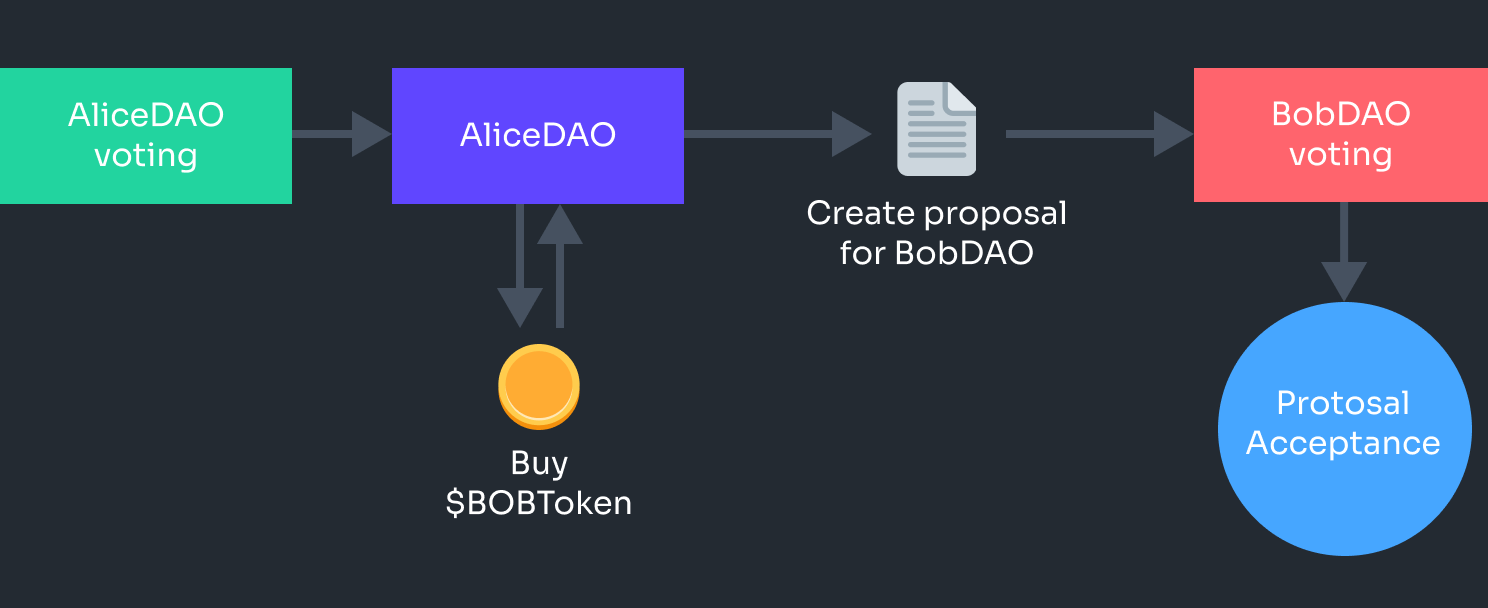

For our purposes, we’ll pretend that there are two DAOs named AliceDAO and BobDAO.

Each DAO runs their own crypto fund and has its native token — $ALICE and $BOB — whose holders are entitled to governance rights over AliceDAO and BobDAO, respectively. Among other matters, $ALICE and $BOB holders can vote to select the assets that will be held in their DAOs fund.

Looking for extra capital investment, the members of AliceDAO, via a Snapshot vote, have clarified their desire for $ALICE to be an asset in the BobDAO fund. To pursue this goal, $ALICE holders authorized an OTC deal to purchase 100 $BOB, the minimum number of tokens required to make a quorum on the weekly votes in which BobDAO selects which assets will be bought/sold from the fund.

In going through with this transaction, $ALICE holders can now vote on governance proposals within BobDAO. When the next guest vote comes around, AliceDAO uses its $BOB holdings to add $ALICE to BobDAO’s fund.

Although it was contested, AliceDAO’s stake was enough to help them win the vote. BobDAO will be purchasing $ALICE from the market!

With this example, we can see metagovernance in action: A DAO (AliceDAO) participated in the governance process of another (BobDAO) through the use of a token (BOB).

It is now clear how powerful governance tokens can be in helping DAOs reach objectives.

FEI & Index Coop Case

Now that we have a high-level understanding of how metagovernance works, let’s dive into some more complex examples so we can better understand how DAOs have begun to utilize metagovernance to further their strategic interests. In doing so, we’ll be able to understand the role that metagovernance tokens play in this process.

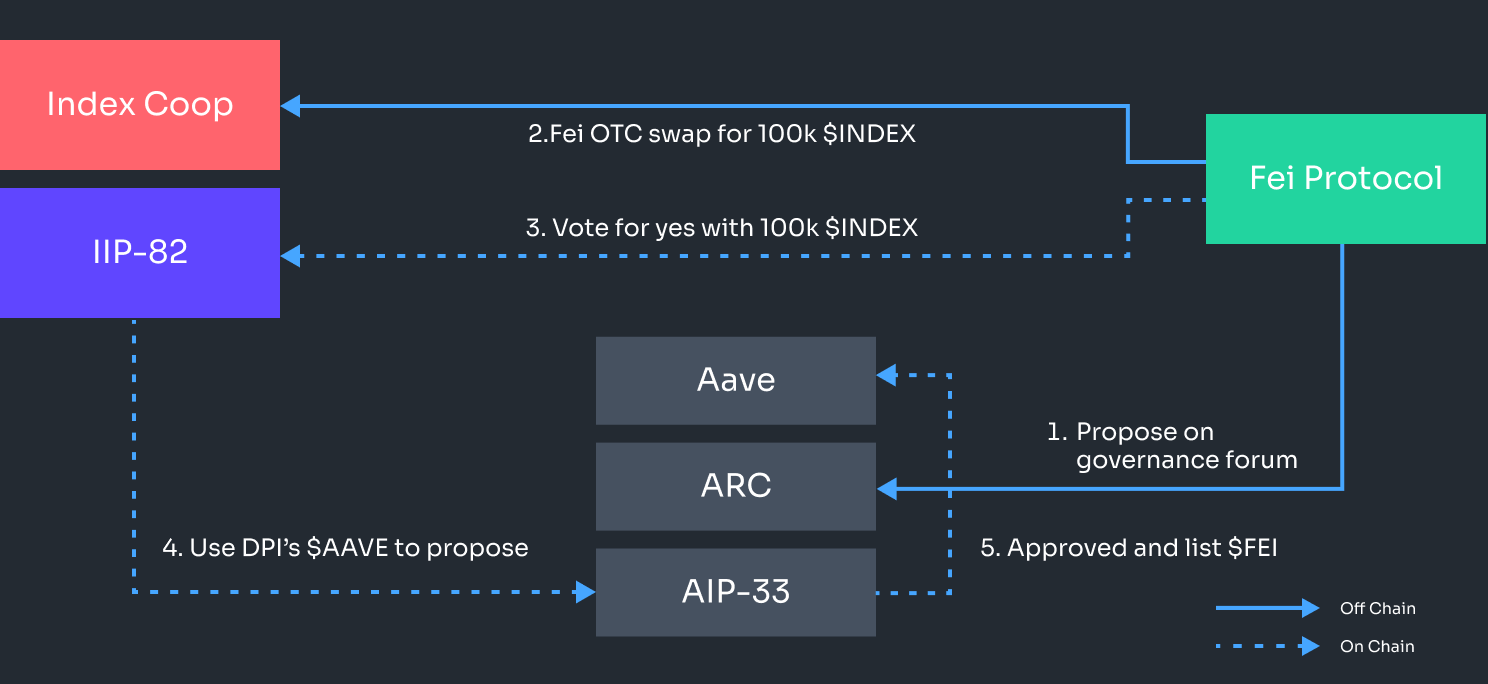

The most well-known example of metagovernance being used to achieve a strategic goal thus far involves Fei Protocol, Aave, and Index Cooperative. In this instance, the stablecoin issuer FEI Protocol successfully got its FEI token listed on the Aave money market by utilizing the metagovernance rights held by the INDEX token of IndexCoop.

Fei Protocol is the issuer of FEI, a fully-reserved, USD-pegged stablecoin. In June 2021, the DAO expressed interest in getting FEI listed on Aave, the largest on-chain money market by TVL. The protocol highly coveted this listing, as integrating with a popular application such as Aave could increase the utility, and therefore demand, for FEI.

However, for FEI to list on Aave, it had to pass through the money market’s decentralized governance process. Given the lack of certainty in how AAVE holders would vote, as well as the minimum 80,000 AAVE (worth ~$20 million at the time) requirement to make a governance proposal, Fei decided to purchase 100,000 INDEX tokens (worth ~$2.5M at the time) to aid in securing this integration. INDEX is the governance token of the Index Cooperative, an asset management DAO behind the creation of indices and structured products such as DPI (DeFi Pulse Index) and GMI (Bankless DeFi Innovation Index).

INDEX holders are entitled to the governance rights of the underlying tokens held within the DAO’s products. These rights make INDEX a metagovernance token or an asset that conveys metagovernance rights to its holders.

INDEX metagovernance is currently enabled for five assets within DPI: UNI, COMP, YFI, BADGER, and AAVE. Instead of purchasing each token individually, a DAO can purchase INDEX and obtain the governance rights for each underlying asset.

After close collaboration with both communities, in September 2021, Fei Protocol utilized the metagovernance rights held by its 100,000 INDEX to participate in the official vote to list FEI on Aave, successfully securing the integration.

In doing so, Fei exercised what is known as “levered metagovernance.” This term was coined because the DAO could “leverage” or extend its governance power. At the time, roughly $4 million worth of INDEX was able to influence the voting power of the ~$36 million AAVE held within DPI. To put a long story short, Fei used $1 of INDEX to control $9 worth of AAVE. This vote demonstrates the incredible power and cost-effectiveness of DAOs utilizing metagovernance to pursue strategic ends. Through the INDEX token, Fei could essentially purchase the governance power needed at a 9x cheaper rate compared to buying the same amount of AAVE outright.

Not only was this event the first significant instance of metagovernance within DeFi, but it also marked the birth of metagovernance tokens as a sub-asset class.

Curve Wars

Another excellent example of metagovernance, on a larger scale - is the so-called Curve Wars.

The Curve War(s) is an ongoing event where different parties fight for Curve voting power to bootstrap liquidity, deepen liquidity, increase yield, and fulfill other self-serving purposes. These parties try to achieve these goals by directing liquidity rewards with veCRV voting power on the gauge (where the rewards come from). We won’t go into the situation any further, as there is an ocean of knowledge to consume, but the situation is worth mentioning from a metagovernance perspective.

A Framework for Evaluating

Now that we understand metagovernance and how it has been used throughout DeFi, let’s discuss a framework for evaluating metagovernance tokens.

Whether it be a DAO wanting to add one to its balance sheet or a retail investor hoping to anticipate and front-run future interest from these entities, there are three main criteria to keep in mind when scouting for and determining the efficacy of metagovernance tokens.

Criteria #1: What are the underlying governance tokens?

The first thing to be aware of regarding a metagovernance token is the set of underlying tokens it controls. It’s important to remember that not all governance power is of equal importance or value to a DAO.

In our previous example, Fei was only interested in utilizing the INDEX token for its AAVE governance rights to secure a listing. Despite INDEX metagovernance controlling a greater quantity of tokens such as UNI, Fei had no strategic interest in utilizing these governance rights.

Think critically about the utility offered by a metagovernance token’s underlying governance rights and which types of DAOs the utility would appeal to.

Criteria #2: What is the process for enacting metagovernance?

Like most on-chain governance systems, a metagovernance vote is typically required to reach a certain minimum voting participation threshold, or quorum, to activate the underlying rights.

While protocols with direct financial incentives for voting, i.e. bribes, almost always reach this minimum threshold, ones without that mechanism in place — such as INDEX — tend not to reach quorum. This voter apathy can lead to wasted governance power. As we’ll see later, voter participation rates are critical in determining the extent to which metagovernance capital can be levered.

In addition, investors must keep in mind the distribution of metagovernance power based on votes. For example, are votes “all or nothing,” meaning that 100% of the underlying tokens are allocated to one voting choice? Or is the governance split proportionally among different choices?

In addition, investors and DAOs should be conscious of the requirements to participate in metagovernance. For example, to participate in Convex governance, and in the future, glBTRFLY metagovernance, token holders must lock their tokens for a minimum period. In contrast, INDEX metagovernance does not necessitate participants taking on this liquidity risk.

Criteria #3: What is the potential levered governance power (LGP) per token?

Perhaps most importantly, investors must assess whether or not they are getting a “good deal” in buying a metagovernance token. A suitable deal means, on a per-dollar basis, a DAO could wield a more significant amount of governance power through utilizing a metagovernance token compared to buying the underlying tokens individually.

In the case of Fei, does one dollar of the metagovernance token influence more than $1 of governance power? Furthermore, based on voter participation rates and the value of the underlying assets held, to what extent can this governance power be levered (LGP)?

INDEX Token

Now that we have our framework for evaluating metagovernance tokens, let’s apply it to the INDEX token. Here, we’re looking to get a sense of how we can analyze the token in practice.

As discussed above, INDEX holders are entitled to governance rights to the UNI, COMP, YFI, BADGER, and AAVE held within the DeFi Pulse Index. The current total value of these assets is $40 million. The most strategically valuable are likely AAVE and COMP, as these tokens can aid in securing listings on the two largest money markets by TVL.

INDEX holders can vote on governance proposals for the five assets listed above via Snapshot vote. To reach a quorum, 5% of the circulating INDEX supply must participate in the vote. Based on the circulating supply, current prices come to roughly $2 million in voting power. Based on the current value of the tokens participating in governance, $1 of INDEX could influence up to an aggregate of $21.98 of governance power. INDEX metagovernance votes are “all or nothing,” meaning that the entirety of the underlying assets will go towards supporting one option within a vote. If a vote does not reach quorum, the metagovernance committee, comprised of five Index community members, will step in and vote. Any INDEX holder can participate in metagovernance, and there is no vote-locking required to do so.